Transferring money across borders has become a vital aspect of modern finance, serving a wide range of purposes such as business payments, tuition fees, overseas investments, or family support. Whether you are sending funds for personal reasons or managing international business obligations, executing an international money transfer efficiently requires more than just access to a bank or online platform. It involves understanding the nuances of exchange rates, transfer fees, regulatory requirements, and secure payment channels. Choosing the right method ensures that funds reach the recipient quickly, safely, and with minimal cost. In addition, technological advancements in fintech have introduced faster, more transparent, and cost-effective solutions for cross-border transfers, making it essential for individuals and businesses to stay informed about available options.

This step-by-step guide breaks down the entire process, helping individuals and businesses make informed decisions while keeping transactions safe and cost-effective.

Understanding International Money Transfer Processes

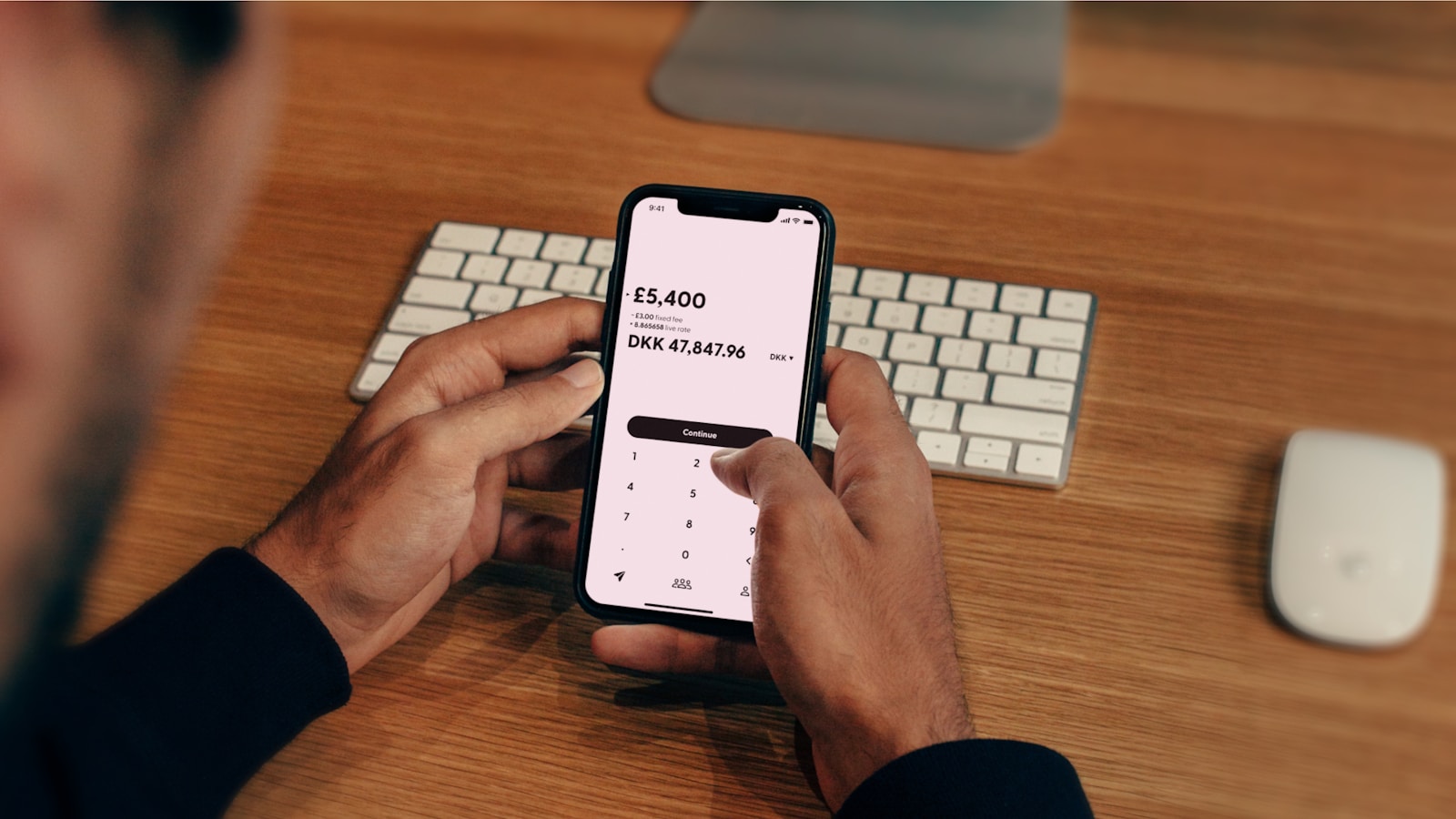

An international money transfer involves sending funds from one country to another through banks, online platforms, or remittance services, making it a vital tool for personal and business financial needs. Exchange rates fluctuate constantly, so monitoring and timing transfers effectively can help minimize costs. Transfers can be executed via traditional banks, online services, or fintech providers, each offering different advantages in terms of speed, convenience, and fees. Compliance requirements, including identity verification and documentation, ensure protection against fraud and money laundering. Depending on the chosen method, transactions can take anywhere from a few minutes to several days, making it essential to understand timelines for efficient planning and ensuring that funds reach the recipient as intended.

Prioritizing Security in Transfers

- Use Trusted Platforms – Always select regulated and verified services with a strong reputation in the market. Trusted platforms provide secure infrastructure, minimizing the risk of fraud or unauthorized access. Using reliable providers ensures that your funds are handled safely from start to finish.

- Encryption and Authentication – Ensure the platform uses end-to-end encryption to safeguard your financial and personal data. Two-factor authentication adds an extra layer of protection during login and transactions. Together, these measures reduce the risk of hacking or data breaches.

- Monitoring and Alerts – Platforms with real-time monitoring allow you to track all transactions instantly. Alerts notify you of any suspicious activity or attempted breaches. This proactive approach helps prevent fraud before it can affect your funds.

- Documentation and Record-Keeping – Keep accurate transaction records, including receipts and confirmation numbers. Documentation provides transparency and is essential for reconciling accounts or resolving disputes. It also ensures compliance with regulatory requirements.

- Compliance Assurance – Choose platforms that adhere to regulations in both the sending and receiving countries. Compliance safeguards against illegal activities like money laundering or fraud. It also ensures that transfers are processed smoothly without legal complications.

Prioritizing security safeguards your funds and ensures peace of mind throughout the transfer process.

Optimizing Speed for Timely Transfers

- Digital Instant Transfers – Many online platforms now provide real-time or same-day transfer options for urgent payments. These services are ideal for situations that require immediate fund availability. Using instant transfer solutions reduces waiting times and enhances convenience for both sender and recipient.

- Bank Transfers – Traditional bank transfers are reliable and widely used for international transactions. However, they may experience delays due to intermediary banks or cross-border regulatory protocols. Planning ahead ensures that funds arrive on time despite these potential slowdowns.

- Mobile Wallet Transfers – Some platforms support direct transfers to mobile wallets, allowing recipients instant access to funds. This method is particularly useful in regions with limited banking infrastructure. Mobile wallet transfers combine speed and accessibility for both individuals and businesses.

- Scheduling and Automation – Planning transfers in advance or setting up recurring payments can save time and reduce manual effort. Automated transfers ensure consistent, timely payments without the need for constant oversight. This is especially useful for businesses managing multiple international transactions.

- Avoid Processing Delays – Be mindful of weekends, public holidays, and different time zones when scheduling transfers. Awareness of these factors prevents unintended delays and ensures smoother transactions. Proper timing enhances efficiency and minimizes disruption to payment schedules.

Selecting the right method ensures recipients get funds quickly without compromising security.

Reducing Costs and Maximizing Savings

- Compare Fees and Rates – Different platforms charge varying service fees and offer different exchange rates. Comparing these options helps identify the most cost-effective solution. Careful evaluation ensures you get the best value for every transfer.

- Choose Mid-Market Rates – Opting for rates close to the mid-market value ensures the recipient receives a higher amount. Avoid inflated rates offered by some providers. This strategy maximizes the efficiency and value of each international transaction.

- Avoid Hidden Charges – Be aware of intermediary, conversion, or processing fees that may reduce the total transferred amount. Always read the fine print before confirming a transfer. Avoiding hidden costs ensures transparency and predictability in expenses.

- Use Multi-Currency Accounts – Maintaining accounts in multiple currencies allows you to transfer funds when rates are favorable. This reduces exposure to fluctuating exchange rates. Multi-currency accounts give you greater control and flexibility in planning transfers.

- Batch Payments for Businesses – For companies sending multiple payments, consolidating them into batch transfers can lower total fees. It also simplifies administrative tasks and reduces processing time. This approach is both cost-effective and efficient for business operations.

Being strategic about costs ensures your transfers are both efficient and financially optimized.

Conclusion

Efficient international transfers require careful planning around security, speed, and savings. By understanding the process, choosing the right platform, managing costs, and staying informed, individuals and businesses can execute transfers confidently and effectively. Additionally, leveraging reliable digital platforms, monitoring exchange rates, and maintaining accurate transaction records ensures that funds are transferred safely, on time, and at optimal value, providing peace of mind and maximizing financial efficiency for every transaction.

For anyone looking to send money internationally, BookMyForexprovides trusted solutions that make money transfer simple, safe, and cost-efficient. With transparent exchange rates, low fees, and fast transfer options, users can send funds confidently to almost any country. The platform also offers real-time tracking, robust security measures, and expert support, ensuring that every transaction is smooth, reliable, and optimized for maximum value.

Leave a Reply